How To Calculate Compound Interest With Different Rates In Excel Calculate Compound Interest With This Handy Table Compound Interest Calculator In Excel Calculate Savings Using FV How To Calculate Compound Interest In Excel Average Compound Interest Rate AlfredMaurice Formula Of Compound Interest With Example Pametno The Excel compound interest formula in cell B4 of the above spreadsheet on the right once again calculates the future value of 100 invested for 5 years with an annual interest rate of 4 However in this example the interest is paid monthly This formula returns the result 122 0996594 I e the future value of the investment rounded to 2 decimal places is 122 10

Answer A 13 366 37 A P I where P principal 10 000 00 I interest 3 366 37 Calculation Steps First convert R as a percent to r as a decimal r R 100 r 3 875 100 r 0 03875 rate per year Then solve the equation for A A P 1 r n nt A 10 000 00 1 03875 12 12 7 5 A 10 000 00 1 0 0032291666666667 90 1 Assume you put 100 into a bank How much will your investment be worth after 1 year at an annual interest rate of 8 The answer is 108 2 Now this interest 8 will also earn interest compound interest next year How much will your investment be worth after 2 years at an annual interest rate of 8 The answer is 116 64 3

Formula Of Compound Interest With Example Pametno 26 Compound Interest Formula Exponential Growth Of Money Part 1 Microsoft Excel Lesson 2 Compound Interest Calculator absolute Formula Compound Interest What Is Compound Interest Nasdaq Mathsde Compound Interest Lesson Video Compound Interest Nagwa Calculate Compound Interest In Excel YouTube Compound Interest Formula With Examples Download Calculate Compound Interest In Excel Gantt Chart Excel Template

How To Calculate Compound Interest With Different Rates In Excel

How To Calculate Compound Interest With Different Rates In Excel

How To Calculate Compound Interest With Different Rates In Excel

https://www.needtosellmyhousefast.com/wp-content/uploads/2016/06/compound-interest-640x427.jpg

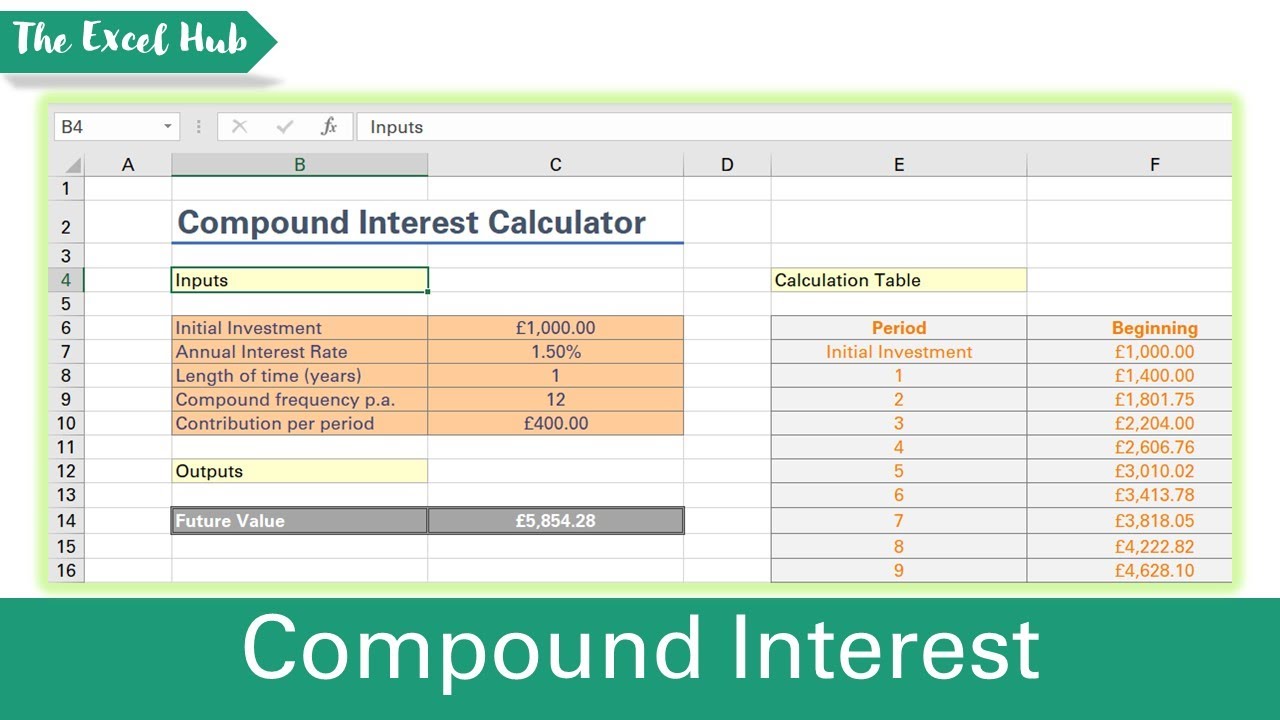

The Benefits of Calculating Compound Interest with Excel There are many benefits of using Excel to calculate compound interest Accuracy Excel helps you to calculate compound interest with precision without making any mistakes that might otherwise occur when calculating manually

Templates are pre-designed documents or files that can be used for different purposes. They can save time and effort by offering a ready-made format and layout for creating various type of material. Templates can be utilized for individual or professional tasks, such as resumes, invitations, leaflets, newsletters, reports, presentations, and more.

How To Calculate Compound Interest With Different Rates In Excel

Top Annual Interest Rate Formula Excel Tips Formulas

26 Compound Interest Formula Exponential Growth Of Money Part 1

Microsoft Excel Lesson 2 Compound Interest Calculator absolute

Formula Compound Interest What Is Compound Interest Nasdaq

Lesson Video Compound Interest Nagwa

Calculate Compound Interest In Excel YouTube

The answer is 11 45 10 7 10 7 0 07 11 45 and your earned interest is 1 45 As you see at the end of the second year not only did you earn 0 70 on the initial 10 deposit you also earned 0 05 on the 0 70 interest that accumulated in the first year

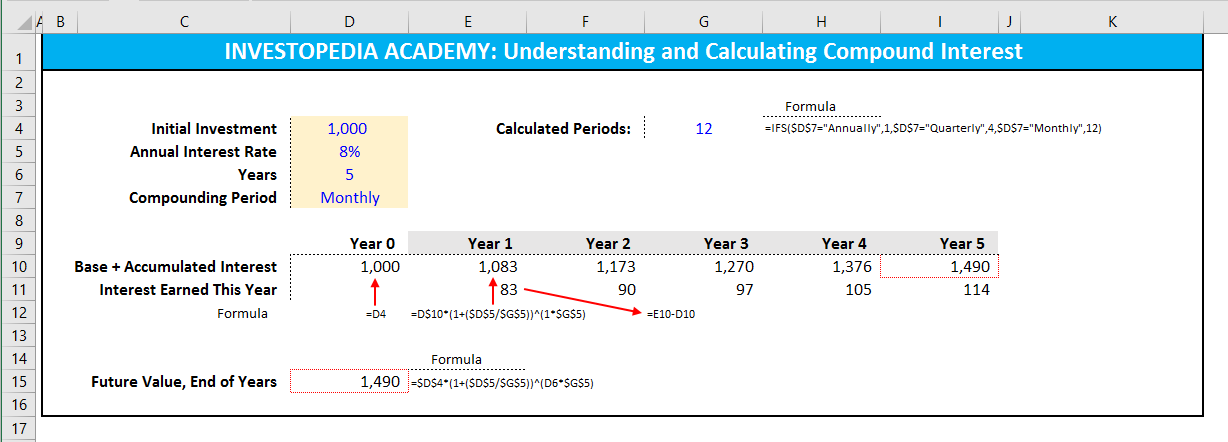

There are two ways to set this up in Excel The most easy to audit and understand is to have all the data in one table then break out the calculations line by line Conversely you could

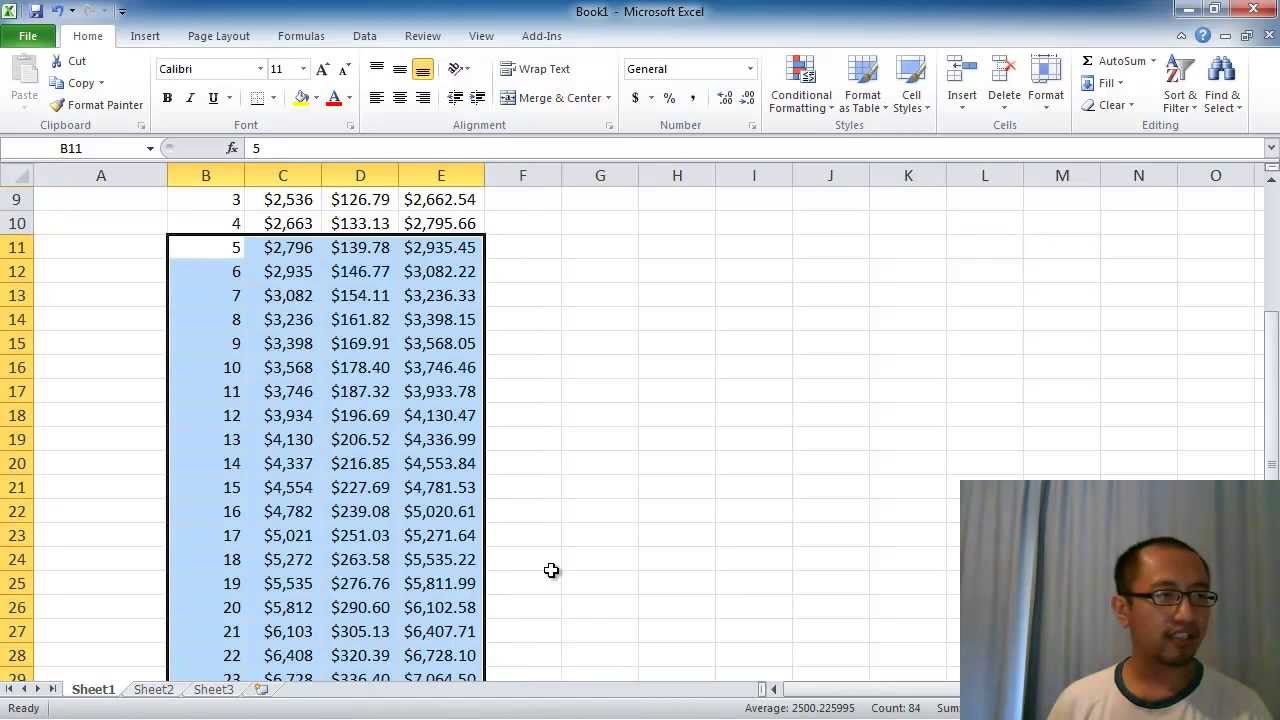

To calculate compound interest in Excel you can use the FV function This example assumes that 1000 is invested for 10 years at an annual interest rate of 5 compounded monthly In the example shown the formula in C10 is FV C6 C8 C7 C8 0 C5 The FV function returns approximately 1647 as a final result Generic formula

1 payment is due at the beginning of the period Guess optional your assumption for what the rate might be If omitted it defaults to 10 7 things you should know about Excel RATE function To efficiently use RATE formulas in your worksheets please pay attention to these usage notes The RATE function calculates through trial and error

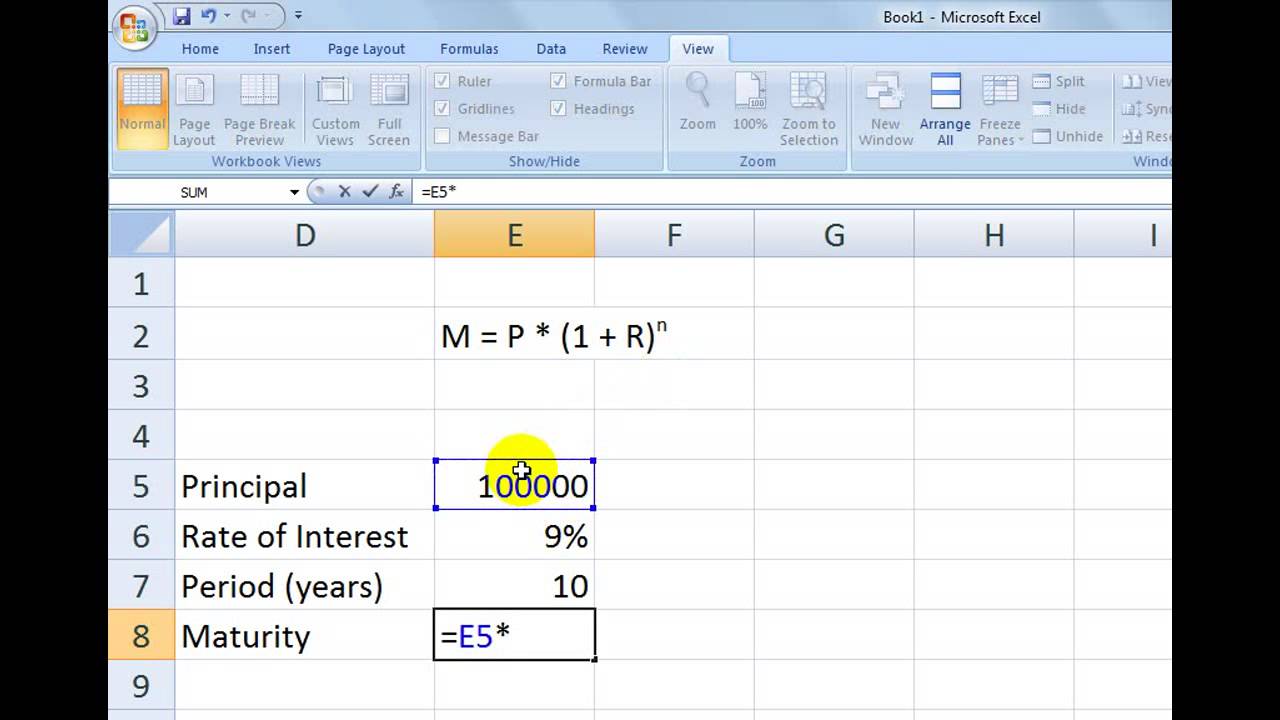

Let s calculate the interest compounded annually for the below data using the formula In Excel enter the general compound interest formula All we have to do is to select the correct cell references So you enter B1 1 B2 B4 B4 B3 You will get the future value using the compound interest formula when you press Enter

Future Value of Investment P 1 R N T N P This is the principal amount or the initial investment R the annual interest rate Note that the rate needs to be in percentage in Excel For example when the compound interest is 10 use 10 or 1 or 10 100 as R T the number of years N Number of time interest is compounded In this article we will guide you through calculating compound interest in Excel including understanding the concept of compound interest different types of compound interest creating a table using built in functions tips and tricks and common errors to avoid Table of Contents Introduction to Compound Interest

The total accumulated value including the principal sum P plus the compounded interest I is given by the formula Where P is the original principal sum P is the new principal sum n is the compounding frequency r is the nominal annual interest rate