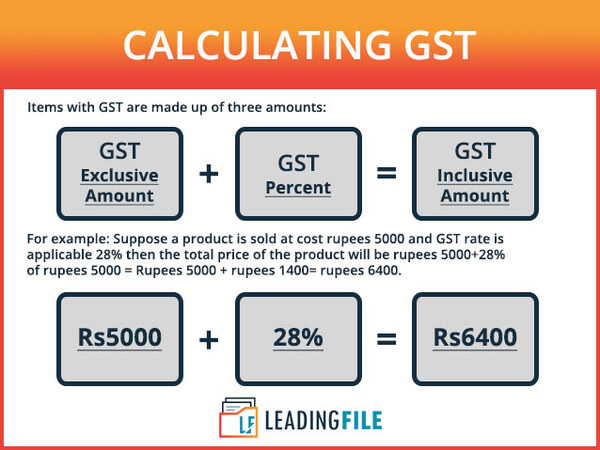

Formula To Calculate Gst In Excel Australia Tip 90 About Gst Australia Calculator Latest Daotaonec How To Calculate GST In Microsoft Excel GST Calculator In Excel YouTube How To Calculate Gst Amount From Total Amount In Excel YouTube How To Calculate GST Amount Online With Formula GST Calculator How To GST Work In Excel Full Work On GST Video GST Formula In Ms The formula for calculating the GST tax is GST amount amount before GST GST rate Click on the column beside GST amount and decide the rate you would like the GST to be We are going with 15 and therefore writing B3 0 15 Note the GST amount has to be in form of percentage and use only between 0 0 to 1

How to calculate Australian goods and services tax 1 minutes On this page This calculator explains How to calculate goods and services tax GST in Australia The amount of GST you will pay or should charge customers The price excluding GST and the total cost including GST Australian GST calculator Price Amount GST status Results Assumptions How to calculate GST We made this GST calculator as user friendly as possible you have to hit Enter or Calculate button first time when entering the amount and you get the inclusive GST and exclusive GST results straight away Entering different amount results update automatically

How To GST Work In Excel Full Work On GST Video GST Formula In Ms How To Calculate GST In Excel With Easy Steps ExcelDemy Automatic Gst Calculation In Excel YouTube How To Calculate Gst In Excel Nsaveri How To Correctly Calculate GST Figures Kiwitax Example Of GST On Sale Of A NCA Solution ACCT10002 Lecture 11 Download GST Calculator In Excel For Reverse Calculation Make Reverse GST Formula In Ms Excel Purchase GST In Ms Excel YouTube Excel Formula Adding Gst How To Calculate Gst Or Income Tax In Excel

Formula To Calculate Gst In Excel Australia

Formula To Calculate Gst In Excel Australia

Formula To Calculate Gst In Excel Australia

https://www.excelatwork.co.nz/wp-content/uploads/2019/10/Calculate-total-including-GST-formula-1.png

GST calculation worksheet for BAS NAT 5107 PDF 111KB This worksheet allows you to work out GST amounts for your business activity statement BAS Don t lodge the worksheet with your BAS We recommend you file it with a copy of the BAS it relates to

Pre-crafted templates provide a time-saving option for creating a diverse variety of files and files. These pre-designed formats and layouts can be made use of for numerous individual and professional projects, including resumes, invitations, leaflets, newsletters, reports, presentations, and more, enhancing the material production process.

Formula To Calculate Gst In Excel Australia

HOW TO CALCULATE GST EXCEL IN HINDI YouTube

How To Calculate GST In Excel With Easy Steps ExcelDemy

Automatic Gst Calculation In Excel YouTube

How To Calculate Gst In Excel Nsaveri

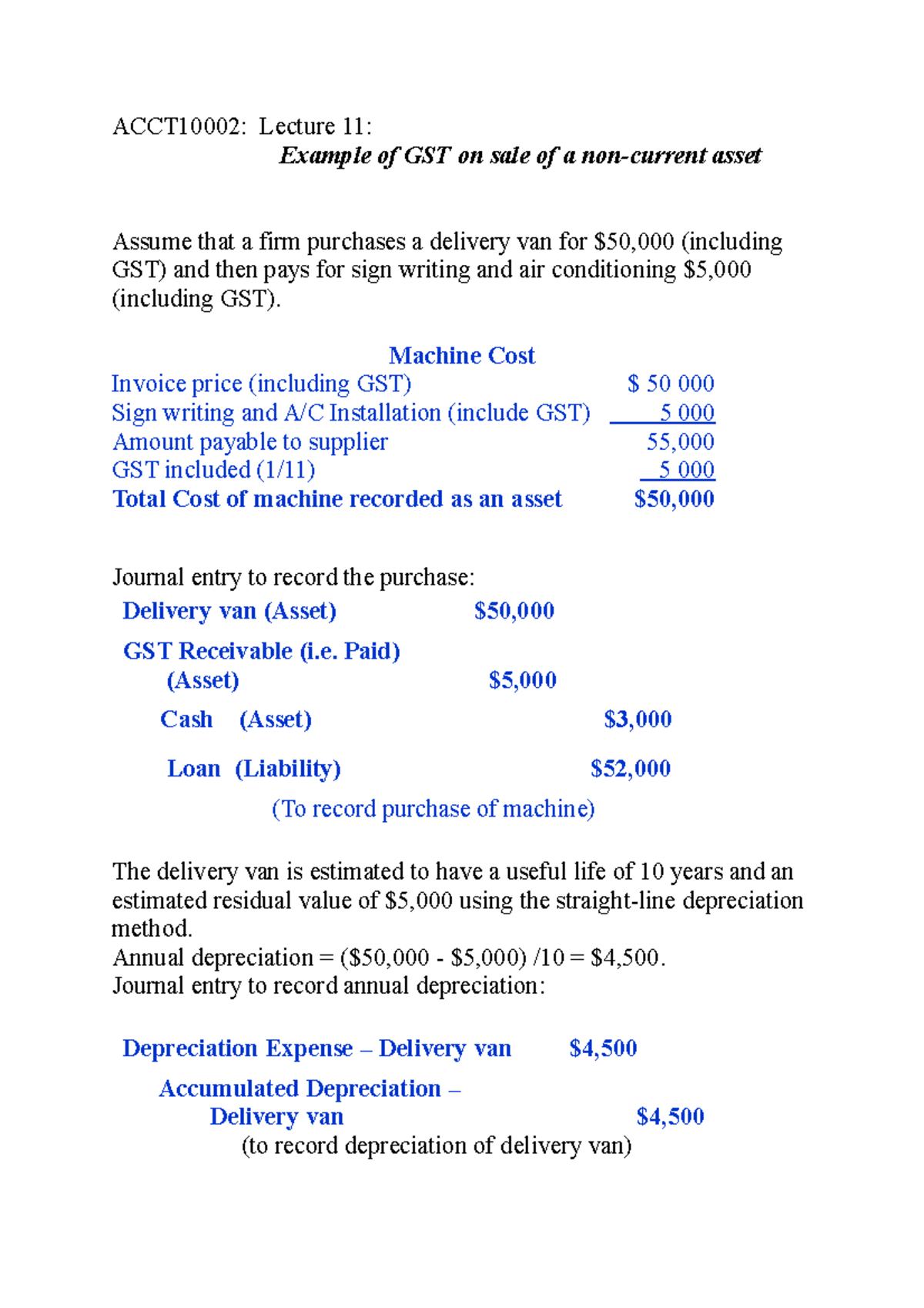

Example Of GST On Sale Of A NCA Solution ACCT10002 Lecture 11

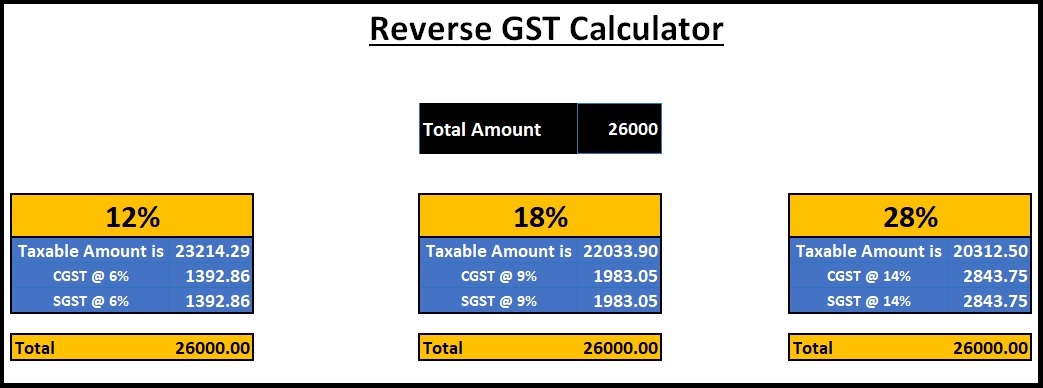

Download GST Calculator In Excel For Reverse Calculation Make Reverse

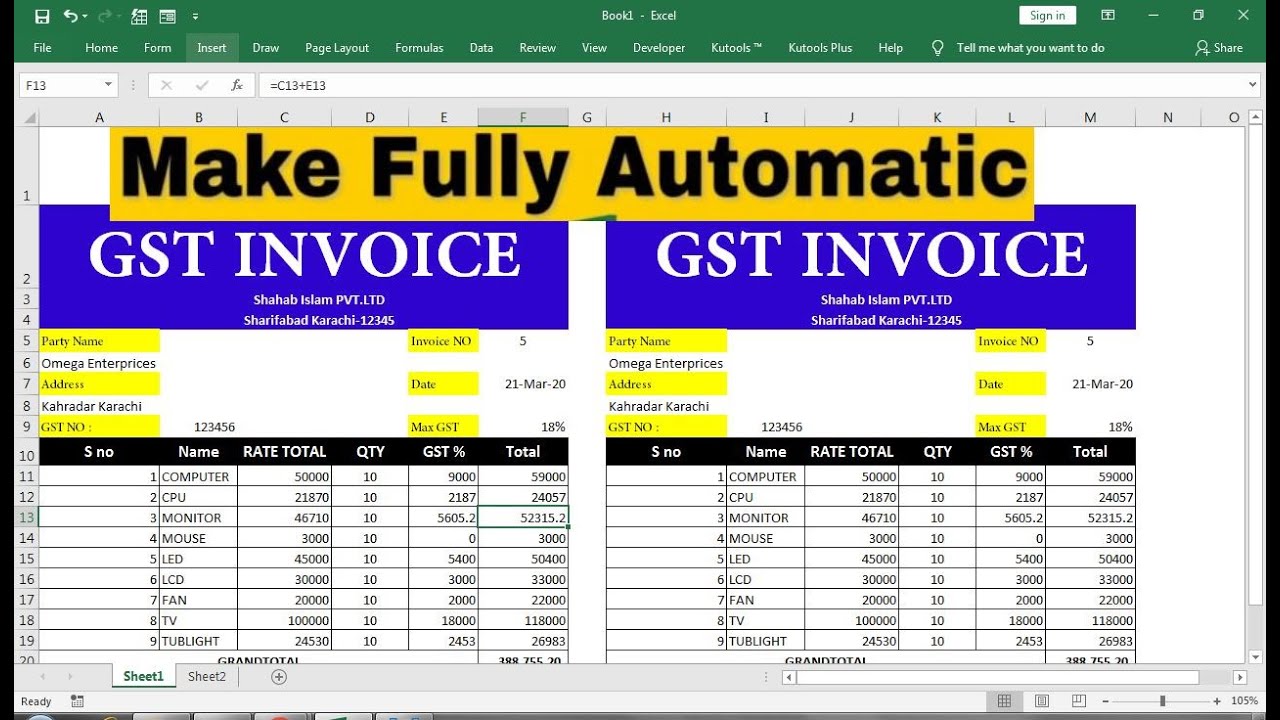

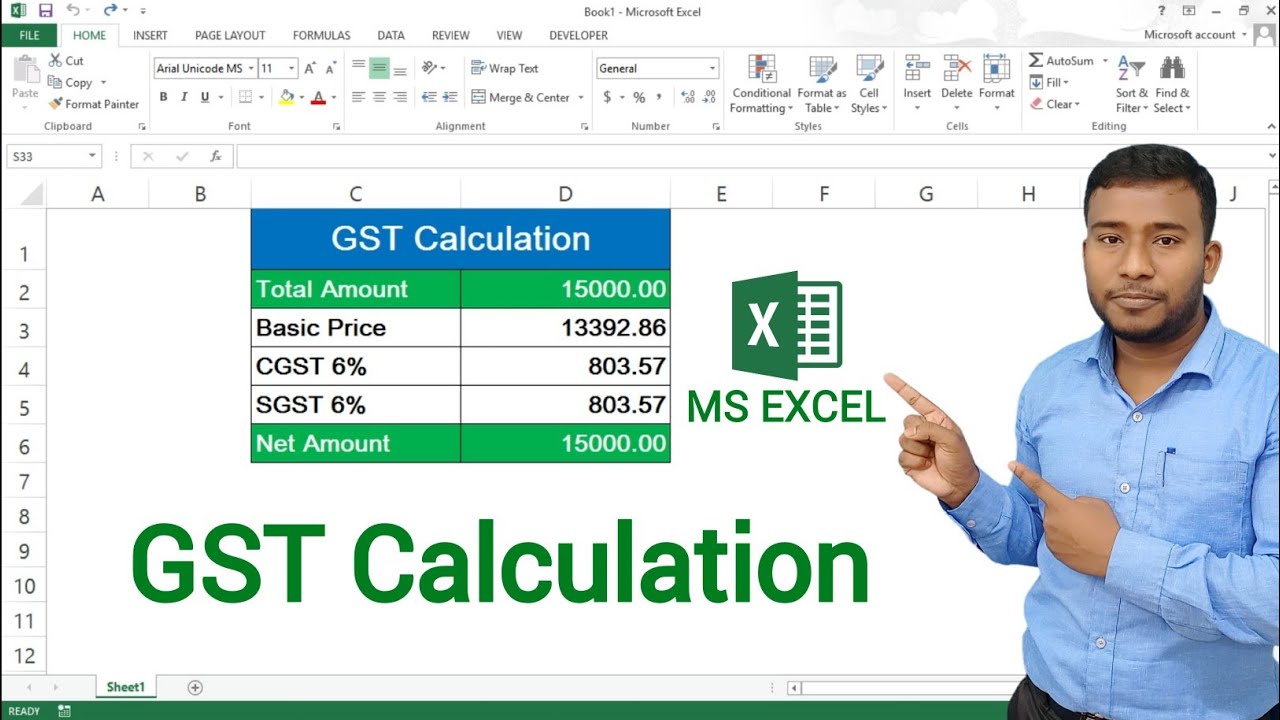

Step 1 Arranging Proper Dataset In this case our goal is to calculate GST But to do so we need a dataset on which we will work The step is First we have the Products in Column B and the Price Without GST in Column C Next we have to create three important columns

1 Click on the cell where you want to calculate GST at 15 B2 2 Go to the Formula bar 3 Write the formula B1 15 Note Alternatively you can write the formula as B1 15 Either way will work 4 Press the Enter key on your keyboard As easy as that your GST value has been calculated

This Australian GST calculator adds 10 to determine a GST inclusive amount and also allows a reverse calculation to determine an included GST amount or the price without GST included The GST rate is normally 10 of taxable value To add GST multiply the price by 1 1 To find a price excluding GST reverse calculator divide the price by 1 1

You do this using a Business Activity Statement BAS Usually done electronically you simply record the details of your total sales the amount of GST you ve collected and the amount of GST you ve paid Any GST you pay on eligible business expenses is offset against the GST you ve collected The balance is paid to the ATO through the BAS

How to calculate GST in Excel by using different techniques with easy step by step tutorial Arif s Education TV 10 1K subscribers Subscribe 303 Share 84K views 7 years ago Learn Excel

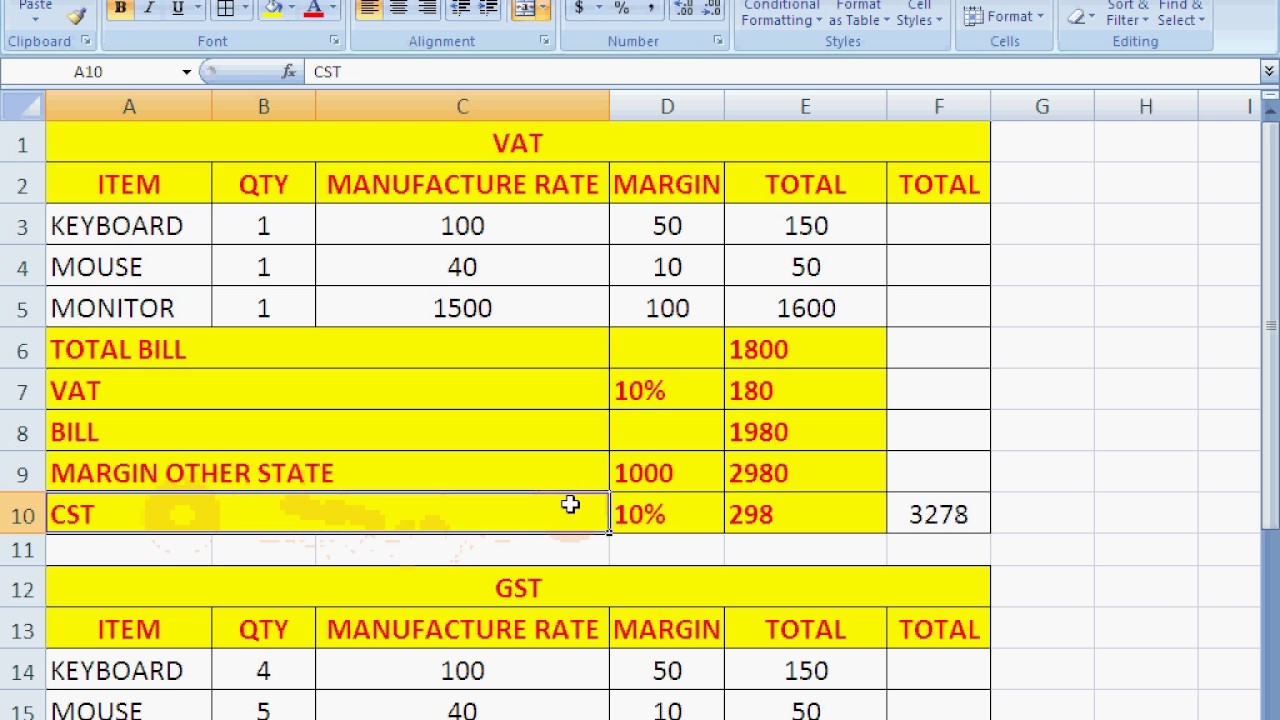

Here a few points to keep in view about GST in Australia GST accounts for 10 of your overall cost Any small business in Australia that generates more than 75 000 in annual revenue must register and collect GST If your non profit generates more than 150 000 in annual revenue you must additionally charge GST Regardless of revenue if you offer a taxi or ride sharing service you must The GST calculation in the worksheet excel will be as follows Step 1 Tabulate your cost price discount freight charges and tax rate in the excel sheet Step 2 Reduce the original price with the cash discount and add freight charges to it In Excel Base Price Original Price Discount Freight Charges B6 B2 B3 B5

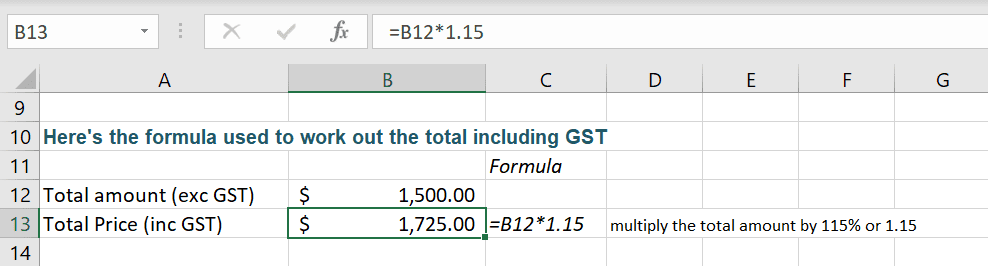

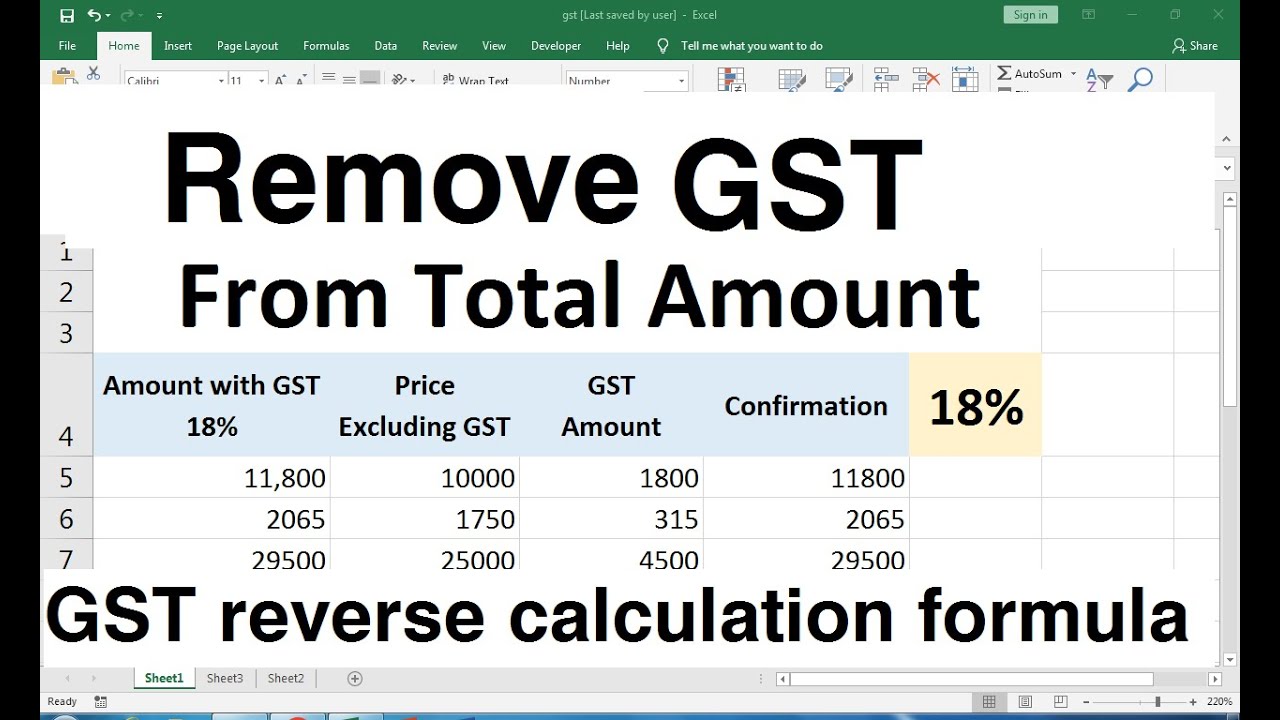

This time we multiply the total by 115 or by 1 15 In the example below cell B12 which is the figure without GST exclusive figure is being multiplied by 1 15 to calculate the Total including GST The same result would have been found if you had used 115 instead of the 1 15 Formula for finding the GST amount from a Total